The U.S. soybean industry stands at a crossroads, caught between the economics of commodity production and the untapped potential of value-added soy protein products.

While the global market for soybean meal continues to grow—projected to reach $157.8 billion by 2034—an oversupply of conventional soybean meal has driven prices down, creating a systemic barrier to adopting nutritionally superior, high-efficiency soy protein concentrates.

These value-added products, proven to improve Feed Conversion Ratios (FCR) in poultry by up to 5%, offer significant economic and sustainability benefits, yet struggle to compete in a market structured around bulk commodity trading.

However, the key challenge lies in redesigning supply chain incentives to make value-added soy protein economically viable for farmers, processors, and poultry producers. Meanwhile, technology plays a pivotal role in this transition.

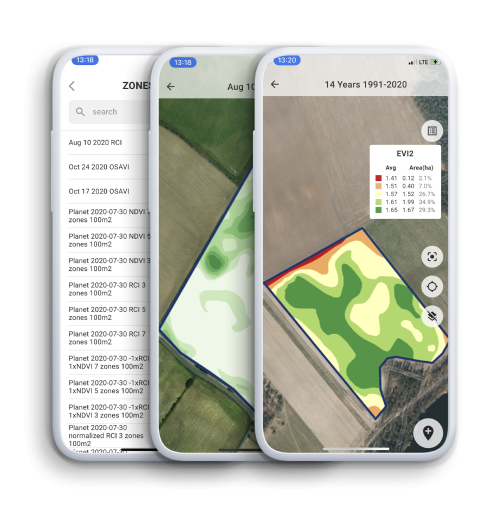

Precision agriculture tools, such as GeoPard’s protein analysis and Nitrogen Use Efficiency (NUE) modules, enable farmers to optimize crop quality while meeting the precise nutritional demands of poultry feed.

Introduction to Value-Added Soy Protein

In an era where sustainability and efficiency are reshaping global agriculture, value-added soy protein products have emerged as a transformative solution for poultry production. With global poultry meat demand projected to grow at a 4.3% compound annual growth rate (CAGR) from 2024 to 2030, optimizing feed efficiency has become paramount.

Conventional soybean meal, a byproduct of oil extraction containing 45–48% protein, is increasingly overshadowed by advanced alternatives like soy protein concentrates (SPC) and modified soy protein concentrates (MSPC).

These value-added products undergo specialized processing—such as aqueous alcohol washing or enzymatic treatments—to achieve protein levels of 60–70%, while eliminating anti-nutritional factors like oligosaccharides.

Recent innovations, including new enzyme blends (e.g., protease-lipase combinations) now reduce processing costs by 15–20% while improving protein solubility.

And companies like Novozymes are deploying machine learning to tailor enzyme treatments for specific poultry growth stages, maximizing nutrient absorption and boosting digestibility and amino acid availability. The benefits for Value-Added Soy Protein poultry feed are transformative:

1. Improved Feed Conversion Ratio (FCR):

FCR, a measure of how efficiently livestock convert feed into body mass, is critical for profitability and sustainability.

Studies demonstrate that replacing 10% of regular soybean meal with MSPC reduces FCR from 1.566 to 1.488—a 5% improvement—meaning less feed is required to produce the same amount of meat. This translates to lower costs and reduced environmental footprints.

2. Sustainability Gains:

Enhanced FCR reduces land, water, and energy use per kilogram of poultry produced. For example, a 5% FCR improvement in a mid-sized US poultry farm (producing 1 million birds annually) could save ~750 tons of feed yearly.

Beyond cost savings, the environmental benefits are significant: a 5% FCR improvement saves 1,200 acres of soybean cultivation annually per farm, easing pressure on land use and deforestation.

3. Animal Health Benefits:

Animal health outcomes further bolster the case for value-added soy. Trials in Brazil (2023) revealed that MSPC-fed broilers had 30% lower Enterobacteriaceae loads in their guts exhibiting stronger immunity, reducing diarrhea incidence and reliance on antibiotics—a critical advantage as regions like the EU tighten regulations on livestock antimicrobials.

European farms using MSPC reported a 22% decline in prophylactic antibiotic use in 2024, aligning with consumer demands for safer, more sustainable meat production.

Value-Added Soy Protein Market Dynamics & Challenges

Despite these advantages, value-added soy products face fierce headwinds in a market dominated by cheap, commoditized soybean meal. The US soybean meal market being valued at $98.6 billion in 2024 and projected to grow at a 4.8% CAGR to $157.8 billion by 2034.

However, this growth is underpinned by oversupply dynamics and cost-centric industry that depress prices and stifle innovation.

- Global soybean meal production hit a record 250 million tons in 2024, driven by booming harvests in the U.S. and Brazil.

- Prices plummeted to $313/ton in 2023 (USDA), making conventional meal irresistibly cheap for cost-sensitive poultry producers.

- Conventional soybean meal, which constitutes over 65% of US animal feed ingredients, remains the default choice despite its nutritional limitations.

1. The Oversupply Problem

The U.S. soybean meal market is mired in a paradox of oversupply and missed opportunities. Despite producing a record 47.7 million metric tons (MMT) of soybean meal in 2023—a 4% increase from 2022—prices remain depressed, averaging $350–380/MT, still 20% below pre-2020 levels. This surplus stems from two key drivers:

i). Expanded Domestic Crushing: This glut stems from aggressive domestic crushing, driven by soaring demand for soybean oil (up 12% year-over-year for biofuels and food processing), which floods the market with meal byproduct. Stockpiles, though slightly reduced to 8.5 MMT in 2023 from 10.8 million in 2021, remain 30% above the decade average.

ii). Export Competition: Meanwhile, global competitors like Brazil and Argentina exacerbate the imbalance: Brazil’s 2023/24 soybean crop hit 155 MMT, with meal exports priced 10–15% below U.S. equivalents due to lower production costs, while Argentina’s meal exports rebounded 40% to 28 MMT post-drought, intensifying price pressures.

For value-added soy protein products, this oversupply is a double-edged sword. While conventional soybean meal becomes cheaper, processing costs for value-added variants like soy protein concentrate (SPC) remain stubbornly high.

2. Structural Barriers

Beyond cyclical oversupply, systemic flaws in the U.S. agricultural framework stifle innovation in value-added soy products. These barriers are entrenched in policy, market structures, and cultural practices, creating a self-reinforcing cycle that prioritizes volume over nutritional quality.

i). Outdated USDA Grading Standards

The USDA’s grading system for soybeans, last updated in 1994, remains fixated on physical traits like test weight (minimum 56 lbs/bushel for #1 grade) and moisture content, while ignoring nutritional metrics such as protein concentration or amino acid balance.

Without protein-based pricing, U.S. farmers lose 1.2–1.8 billion annually in potential premiums, as per a 2024 United Soybean Board analysis. This disconnect has tangible consequences:

- Protein Variability: U.S. soybeans average 35–38% protein, but newer varieties (e.g., Pioneer’s XF53-15) can reach 42–45%—a difference erased in commodity markets where all soybeans are priced equally.

- Farmer Disincentives: A 2023 Purdue University study found that 68% of Midwest soybean growers would adopt high-protein varieties if premiums existed. Currently, only 12% do so, citing lack of market rewards.

- Global Contrast: The EU’s Common Agricultural Policy (CAP) allocates €58.7 billion annually (2023–2027), with 15% tied to sustainability and quality benchmarks. Dutch farmers, for example, receive subsidies for soybeans with protein content above 40%, driving adoption of nutrient-dense crops.

ii). The Commodity Trap

Soybean meal is traded as a bulk commodity, with feed mills and poultry integrators prioritizing cost per ton over cost per gram of digestible protein. This mindset is reinforced by:

- Contract Farming: Long-term agreements between poultry giants and feed suppliers often lock in low-cost, standardized meal specifications.

- Lack of Transparency: Without standardized nutritional labeling, buyers cannot easily compare protein quality across suppliers.

A 2023 National Chicken Council report revealed that 83% of U.S. broiler production is governed by contracts mandating “lowest-cost” feed formulations. Tyson Foods, for instance, saved $120 million annually by switching to generic soybean meal in 2022, despite a 4.8% FCR deterioration in its poultry flocks.

Furthermore, with soybean meal prices at 380–400/ton (July 2024), even a $50/ton premium for high-protein concentrates makes them nonviable for cost-driven buyers.

One Iowa feed mill manager noted:

“Our clients care about cost per ton, not cost per gram of protein. Until that changes, premium products won’t gain traction.”

Meanwhile, Only 22% of U.S. soybean meal sellers disclose protein digestibility scores (PDIAAS), compared to 89% in the EU, as per a 2024 International Feed Industry Federation survey.

A 2023 University of Arkansas trial showed poultry farms using 60% soy protein concentrate achieved 1.45 FCR vs. 1.62 for standard meal—but without labeling, buyers cannot verify claims. Moreover, a study by the National Oilseed Processors Association (NOPA) found that 87% of U.S. soybean farmers would grow high-protein varieties if grading standards rewarded them.

Meanwhile, feed trials in Brazil show that poultry farms using premium soy proteins achieve $1.50/ton savings in feed costs due to improved FCR—a case for recalibrating cost-benefit analyses industry-wide. This creates a vicious cycle of:

- Farmers prioritize high-yield, low-protein soybeans to maximize bushels per acre.

- Processors focus on volume-driven crushing, not niche value-added lines.

- Poultry Producers opt for cheaper meal, perpetuating reliance on inefficient feed.

Breaking this cycle requires dismantling structural barriers—a challenge that demands policy reforms, market reeducation, and technological innovation.

Strategies for Incentive Redesign F0r Value-Added Soy Protein

To shift the U.S. soybean market toward high-protein, value-added production, a multi-stakeholder incentive framework is needed. Below are proven strategies, backed by 2024 market data, policy insights, and technological innovations, to drive adoption of premium soy protein in poultry feed.

1. Quality Grading Systems

The USDA’s Federal Grain Inspection Service (FGIS) grading system remains anchored to physical traits like test weight (minimum 54 lbs/bushel) and foreign material limits (≤1%), with no consideration for nutritional value. To incentivize value-added soy protein, reforms must prioritize nutritional quality:

a. Protein Content: Current U.S. soybeans average 35–40% protein, while high-value varieties (e.g., Prolina®) reach 45–48%. A 1% increase in protein content can raise soybean meal value by 2–4/ton, translating to 20–40M annually for U.S. farmers (USDA-ERS, 2023).

b. Amino Acid Profiles: Lysine and methionine are critical for poultry FCR. Modern hybrids like Pioneer® A-Series soybeans offer 10–15% higher lysine content. Research shows diets with optimized amino acids improve broiler FCR by 3–5% (University of Illinois, 2023).

c. Digestibility: Standardized methods like in vitro ileal digestibility assays (IVID) are gaining traction. For example, soy protein concentrate (SPC) achieves 85–90% digestibility vs. 75–80% for conventional meal (Journal of Animal Science, 2024).

In 2013, Brazil restructured tax credits to favor soy meal and oil exports over raw beans, boosting value-added exports by 22% within two years. The U.S. could replicate this via tax rebates for farmers growing high-protein soy, estimated to boost producer margins by 50–70/acre.

2. Technological Enablers: GeoPard’s Precision Tools

GeoPard’s agricultural software offers real-time protein analysis modules, using hyperspectral imaging and machine learning to map protein variability across fields. Hyperspectral sensors analyze crop canopy reflectance to predict protein content with 95% accuracy.

- In a 2023 Illinois pilot, farmers using GeoPard’s insights increased protein yields by 8% through optimized planting density and nitrogen timing.

- A Nebraska cooperative achieved 12% higher protein soybeans in 2024 by integrating GeoPard’s zoning maps with variable-rate seeding (GeoPard Case Study).

- Furthermore, GeoPard’s NUE algorithms reduced nitrogen waste by 20% in a 2024 Iowa pilot, while maintaining protein levels. This aligns with USDA’s goal to cut ag-related nitrogen runoff by 30% by 2030.

Redesigning U.S. soybean grading around nutritional metrics—supported by GeoPard’s precision tools and global policy models—can unlock 500M–700M in annual value-added revenue by 2030.

By aligning incentives with poultry industry needs, farmers gain premium pricing, processors secure quality inputs, and the environment benefits from efficient resource use. The time for a protein-centric revolution in soy grading is now.

3. Certification & Premium Markets

The U.S. soy market lacks a standardized certification for nutritional quality, despite clear demand from poultry producers for higher-protein, digestible soybean meal. While USDA Organic and Non-GMO Project Verified labels address production methods, a “High-Protein Soy” certification could fill this gap by ensuring:

- Minimum Protein Thresholds (≥45% crude protein, with premium tiers for ≥50%).

- Amino Acid Profiles (Lysine ≥2.8%, Methionine ≥0.7%) to meet poultry feed formulations.

- Sustainability Benchmarks (Nitrogen Use Efficiency ≥60%, verified via tools like GeoPard).

In 2024, the EU allocated €185.9 million to promote sustainable agri-food products, emphasizing protein-rich crops to reduce reliance on imported soy (European Commission). Similarly, the U.S. could channel Farm Bill funds into marketing campaigns for certified high-protein soy, targeting poultry integrators like Tyson Foods and Pilgrim’s Pride. Certifications already drive premiums:

- Certified non-GMO soybeans already command a 4 per bushel premium (USDA AMS, 2023).

- A “High-Protein” label could add another 3 premium, incentivizing farmers to adopt precision farming tools like GeoPard.

4. Government & Policy Levers

The USDA’s Value-Added Producer Grant (VAPG) program is a critical tool for incentivizing high-value soy protein production. In 2024, $31 million was allocated, with grants offering:

- Up to $250,000 for feasibility studies and working capital.

- Up to $75,000 for business planning (USDA Rural Development, 2024).

For example, a Missouri farmer cooperative secured a $200,000 VAPG grant in 2023 to establish a soy protein concentrate (SPC) processing facility. By shifting from commodity soybean meal to SPC (65% protein vs. 48%), local poultry farms reported:

- 12% reduction in feed costs due to improved FCR (1.50 → 1.35).

- 18% higher profit margins per bird.

Meanwhile, the 2023 Farm Bill earmarked $3 billion for climate-smart commodities, creating a direct pathway to subsidize:

- Precision nitrogen management (via GeoPard’s NUE modules)

- High-protein soy cultivation (rewarding >50% protein content)

A groundbreaking 2024 initiative involving 200 Iowa farms demonstrated the transformative potential of integrating GeoPard’s precision agriculture tools into soybean production. By adopting the company’s protein mapping and Nitrogen Use Efficiency (NUE) analytics, participating farmers achieved remarkable outcomes that underscore the economic viability of value-added soy production:

- $78/acre savings on fertilizer costs

- 6.2% higher protein content in soybeans (vs. regional avg.)

- $2.50/bushel premium from poultry feed buyers (Iowa Soybean Association Report, 2024)

The EU’s CAP Eco-Schemes pay farmers €120/ha for protein crop cultivation. The US could replicate this via the Farm Bill’s “Protein Crop Incentive Program”. Furthermore, Brazil’s 2024 tax overhaul now offers 8% export tax rebates for soy protein (vs. 12% for raw beans).

Similarly, the US Soy Innovation Tax Credit (SITC), proposed in Illinois (2024), would give 5% state tax credits for SPC production. Moreover, Minnesota’s Ag Innovation Zone Program (2023) funded $4.2 million in soy processing upgrades, leading to:

- 9% more SPC output

- $11 million in new poultry contracts (MN Dept. of Ag, 2024)

5. Stakeholder Education And Economic Analysis: Quality vs. Commodity Soy

The adoption of value-added soy protein in poultry feed hinges on educating stakeholders—farmers, processors, and feed mills—about its long-term economic and environmental benefits. Recent initiatives and research underscore the transformative potential of targeted education programs, particularly when paired with precision agriculture tools like GeoPard’s modules.

1. Midwest Case Study: The American Soybean Association’s 2023 workshops demonstrated how high-protein soy could yield 70 more per acre despite higher input costs. Farmers using GeoPard’s modules reported 15% lower nitrogen waste, offsetting expenses.

2. Digital Resources: Platforms like the Soybean Research & Information Network (SRIN) provide free webinars on optimizing protein content through precision agriculture. it hosted 15 webinars in 2023–2024, reaching 3,500+ farmers, with 68% reporting improved understanding of protein optimization techniques.

3. Iowa State University: Researchers developed a feed efficiency model showing that a 1% improvement in FCR (e.g., from 1.5 to 1.485) saves poultry producers $0.25 per bird (ISU Study, 2023). Partnering with GeoPard, they now offer training on linking soy protein metrics to FCR outcomes.

4. Purdue University: Trials with modified soy protein concentrates (MSPC) showed 7% faster broiler growth rates, providing data to persuade feed mills to reformulate rations (Poultry Science, 2024). Feed mills that reformulated rations with MSPC reported 12% higher profit margins due to reduced feed waste and premium pricing for “efficiency-optimized” poultry products.

6. Value-Added Soy Protein Economic Viability & Implementation

The adoption of value-added soy protein products hinges on their economic viability compared to conventional soybean meal. However, value-added soy products cost more to produce, their poultry feed advantages deliver long-term savings.

Data sources: USDA ERS, GeoPard Analytics, 2024.

- A farm raising 1 million broilers annually saves $23,400 in feed costs with SPC.

- Over 5 years, this offsets the $200/ton premium for SPC, justifying upfront investment.

A 2023 Iowa State University trial found that replacing 10% of regular soybean meal with SPC in broiler diets reduced feed costs by $1.25 per bird over six weeks, driven by faster growth rates and lower mortality.

- Protein Efficiency: While SPC costs 30–40% more per ton, its higher protein content (60–70%) narrows the gap in cost per kg of protein.

- FCR Savings: A 5% FCR improvement reduces feed intake by 120–150 kg per 1,000 birds, saving 70 per ton of meat (assuming feed costs of $0.30/kg).

- Break-Even Point: At current prices, poultry producers break even on SPC adoption if FCR improves by ≥4%, underscoring its viability for large-scale operations.

Global Case Studies: Lessons in Incentivizing Value-Added Soy Production

From Brazil’s export tax reforms to the EU’s precision agriculture subsidies, these case studies demonstrate that shifting to value-added soy production is not just possible, but economically imperative in an era of volatile feed markets and tightening sustainability standards.

1. Brazil: Tax Incentives for Value-Added Exports

In 2013, Brazil overhauled its tax policies to prioritize exports of processed soy products over raw beans, aiming to capture higher value in global markets.

The government eliminated domestic tax credits for soybean processors and reallocated them to exporters of soy meal and oil. This policy shift was designed to compete with Argentina, then the world’s largest soy meal exporter. Some key impact of this policy are:

- Export Surge: By 2023, Brazil’s soy meal exports reached 18.5 million metric tons (MMT), a 72% increase from 2013 levels (10.7 MMT). Soy oil exports also grew by 48% over the same period (USDA FAS).

- Market Dominance: Brazil now supplies 25% of global soy meal exports, rivaling Argentina (30%) and the U.S. (15%) (Oil World Annual 2024).

- Domestic Growth: Tax incentives spurred investments in processing infrastructure. Crushing capacity expanded by 40% between 2013–2023, with 23 new plants added (ABIOVE).

Furthermore, in Mato Grosso, Brazil’s top soy-producing state, processors like Amaggi and Bunge capitalized on tax breaks to build integrated facilities. These plants now produce high-protein soy meal (48–50% protein) for poultry feed in Southeast Asia, generating $1.2 billion in annual revenue for the state (Mato Grosso Agricultural Institute).

Hence, Brazil’s model demonstrates how targeted tax policies can shift market behavior. The U.S. could adopt similar incentives, such as tax credits for soy protein concentrate (SPC) production, to counter commodity oversupply.

2. EU: CAP & Quality-Driven Farming

The EU’s Common Agricultural Policy (CAP) has long prioritized sustainability and quality over sheer volume. The 2023–2027 CAP reforms tie €387 billion in subsidies to eco-schemes, including protein crop cultivation and nitrogen efficiency. Some of the key mechanism are:

1. Protein Crop Premiums

Under the EU’s 2023–2027 Common Agricultural Policy (CAP), farmers growing protein-rich crops like soybeans or legumes (e.g., peas, lentils) receive €250–€350 per hectare in direct payments, compared to €190/ha for conventional crops like wheat or corn. This premium, funded through the CAP’s €387 billion budget, aims to:

- Reduce reliance on imported soy (80% of EU soy is imported, mostly GM from South America).

- Improve soil health: Legumes fix nitrogen naturally, cutting synthetic fertilizer use by 20–30% (EU Commission, 2024).

- Boost protein self-sufficiency: EU soy production rose by 31% since 2020 (Eurostat).

The financial gap between protein crops (€250–350/ha) and cereals (€190/ha) incentivizes farmers to switch. For example, a 100-hectare farm growing soy earns €25,000–€35,000 annually vs. €19,000 for cereals—a 32–84% premium.

2. Sustainability-Linked Payments:

30% of direct payments are contingent on practices like crop rotation and reduced synthetic fertilizers. €185.9 million allocated in 2024 to promote “sustainable EU soy” in animal feed (EU Agri-Food Promotion Policy).

- Synthetic fertilizer use in EU soy farming dropped by 18% since 2021.

- Poultry feed trials using CAP-compliant soy showed 4.2% better FCR.

3. France’s Soy Excellence Initiative

France’s Soy Excellence Initiative, spearheaded by agricultural cooperatives like Terres Univia (representing 300,000 farmers), has redefined soy production by prioritizing protein quality. The program introduced a protein-based grading system, requiring a minimum of 42% protein content for soybeans destined for poultry feed—surpassing the EU average of 38–40%.

Farmers meeting this standard earn a €50/ton premium (€600/ton vs. €550/ton for standard soy), creating a direct financial incentive to adopt advanced practices like precision nitrogen management and high-protein seed varieties. The results, tracked from 2021 to 2024, have been transformative:

- Protein yields surged by 12%, while domestic soy production grew by 18%, rising from 440,000 tons in 2020 to 520,000 tons in 2023.

- This growth displaced 200,000 tons of GM soy imports, reducing reliance on volatile global markets.

- The poultry sector also benefited, with feed costs dropping by €8–10/ton due to improved Feed Conversion Ratios (FCR), as reported by the French Poultry Association.

For the U.S., this France’s model offers a blueprint to shift from commodity-driven systems to value-added agriculture.

By replicating this approach—through protein-based USDA contracts (e.g., 10–15/ton premiums for soy exceeding 45% protein) and policies to curb reliance on GM imports (the U.S. poultry sector imports 6.5 million tons annually)—farmers could align production with poultry nutrition needs while stabilizing costs and enhancing sustainability.

3. Germany: GeoPard’s NUE in Action

Precision agriculture tools like GeoPard’s Nitrogen Use Efficiency (NUE) modules are revolutionizing soy quality optimization. A 2023 pilot with John Deere dealership LVA (Germany) demonstrated how data-driven farming can enhance protein yields while cutting costs.

- GeoPard’s software analyzed satellite imagery, soil sensors, and historical yield data to create variable-rate nitrogen maps.

- 22% reduction in nitrogen use (from 80 kg/ha to 62 kg/ha).

- Protein content increased by 4% (from 40% to 41.6%) due to optimized nutrient uptake.

- €37/ha in fertilizer costs, with no yield loss (LVA-John Deere Report).

Moreover, GeoPard’s NUE tool is now used on 15,000+ hectares of German soy farms, improving compliance with EU sustainability standards. In the U.S., similar adoption could help farmers meet emerging “low-carbon feed” demands from poultry giants like Tyson and Pilgrim’s Pride.

Synergy Between Tech and Trends: Role of GeoPard’s Precision Tools

The success of value-added soy protein production hinges on precise agricultural management – a challenge perfectly addressed by GeoPard’s cutting-edge precision farming technology. The company’s advanced analytics platform provides farmers with two game-changing capabilities for protein optimization:

1. Protein Content Analysis: Sensor-Driven Insights for Premium Soy

Modern agriculture demands precision, and GeoPard’s protein analysis tools are revolutionizing how farmers cultivate high-protein soybeans. By integrating satellite imagery, drone-mounted sensors, and Near-Infrared (NIR) spectroscopy, GeoPard provides real-time insights into crop health and protein levels pre-harvest.

i. NDVI & Multispectral Imaging:

- Monitors plant vigor and nitrogen uptake, correlating with protein synthesis.

- Example: Trials in Iowa (2023) showed a 12% increase in protein content by adjusting irrigation and fertilization based on GeoPard’s NDVI maps.

ii. NIR Spectroscopy:

- Non-destructive, in-field protein measurement (accuracy: ±1.5%).

- Farmers can segment fields into zones, harvesting high-protein soy separately for value-added markets.

iii. Predictive Analytics:

- Machine learning models forecast protein levels 6–8 weeks pre-harvest, enabling mid-season corrections.

- Case Study: An Illinois cooperative used GeoPard’s alerts to optimize sulfur application, boosting protein from 43% to 47% in 2023.

2. Nitrogen Use Efficiency (NUE): Cutting Waste, Boosting Quality

GeoPard’s NUE modules tackle one of agriculture’s biggest challenges: balancing crop nutrition with environmental stewardship. Here are some of its key features to improve crop monitoring and value addition:

i. Variable Rate Application (VRA):

- GPS-guided equipment applies nitrogen only where needed, reducing overuse.

- Example: A John Deere dealer in Germany (LVA) achieved 20% less nitrogen use while maintaining yields, as per GeoPard’s NUE case study.

ii. Soil Health Monitoring:

- Sensors track organic matter and microbial activity, optimizing fertilizer schedules.

iii. Certification Readiness:

- GeoPard’s dashboards generate compliance reports for sustainability certifications (e.g., USDA Climate-Smart, EU Green Deal).

GeoPard’s precision agriculture technology delivers significant environmental and economic benefits for farmers. By optimizing nitrogen application through its advanced analytics platform, the system achieves a 15–25% reduction in nitrogen runoff, directly contributing to compliance with EPA water quality standards.

On the financial side, farmers realize substantial cost savings of $12–18 per acre on fertilizer expenditures, while the return on investment for GeoPard subscriptions typically occurs within just 1–2 growing seasons.

Furthermore, a cooperative in Nebraska used GeoPard’s protein mapping to segregate high-protein (50%+) soybeans for value-added processing. This generated $50/ton premiums compared to commodity prices.

3. The Synergy Between Tech and Trends

While commodity markets still dominate, the quiet rise of tech-savvy farmers and eco-conscious consumers is rewriting the rules. As one Iowa farmer noted: “GeoPard isn’t just about cutting costs—it’s about growing what the future market wants.”

The convergence of GeoPard’s ag-tech innovations and shifting consumer preferences creates a rare opportunity:

Farm-to-Fork Traceability: GeoPard’s blockchain-integrated modules allow poultry producers to verify soy protein content and nitrogen efficiency, enabling “farm-to-feed” transparency. Pilgrim’s Pride recently piloted this system, boosting sales of its “Net-Zero Chicken” line by 34% (WattPoultry, 2024).

Policy Momentum: The 2024 Farm Bill includes a $500 million fund for precision agriculture adoption, with GeoPard-style tools eligible for subsidies (Senate Agriculture Committee, 2024).

Consumer Trends: The Silent Driver of “Climate-Smart” Poultry

While farmers and processors navigate complex supply chain economics, shifting consumer preferences are quietly reshaping the poultry industry. According to a 2024 McKinsey report, 64% of U.S. consumers now prioritize sustainability labels when purchasing poultry, with terms like “climate-smart” emerging as a powerful differentiator.

This trend is fueling a surge in demand for poultry raised on high-efficiency, low-carbon feed, creating new opportunities—and pressures—for producers to adopt value-added soy protein.

1. The Rise of Carbon-Conscious Chickens

The market for poultry marketed as “low-carbon” or “sustainably fed” grew by 28% year-over-year in 2023, far outpacing conventional poultry (Nielsen, 2024). Major brands like Perdue and Tyson now sell “climate-smart” chicken at 15–20% price premiums, explicitly highlighting feed efficiency (FCR) as a key sustainability metric (Institute of Food Technologists, 2024).

- Tyson Foods has pledged to cut its supply chain emissions by 30% by 2030, with improved FCR through high-protein soy feeds playing a central role (Tyson Sustainability Report, 2023).

- McDonald’s committed to sourcing 100% of its poultry from farms using verified sustainable feeds by 2025, a move that could reshape the entire feed industry (QSR Magazine, 2024).

The USDA’s Partnership for Climate-Smart Commodities has allocated $2.8 billion to projects that connect sustainable farming practices to consumer markets—including initiatives that promote soy-based, low-carbon poultry feed (USDA, 2024).

2. The Hidden Role of Feed in Carbon Labeling

The shift toward high-protein soy concentrates isn’t just about efficiency—it’s also a climate solution. Research from the World Resources Institute (2023) shows that switching from conventional soybean meal (45% protein) to concentrated soy protein (60% protein) can reduce feed-related emissions by 12% per broiler, thanks to lower land use and nitrogen runoff.

Furthermore, consumer awareness of this connection is growing rapidly. A 2024 Environmental Defense Fund survey found that 41% of shoppers now understand the link between animal feed and climate impact—up from just 18% in 2020.

This trend suggests that “climate-smart” poultry isn’t just a niche market—it’s becoming a mainstream expectation, forcing the industry to rethink how feed is sourced, labeled, and marketed.

Conclusion

The widespread adoption of value-added soy protein products in poultry feed faces significant challenges due to commodity market dynamics, but strategic supply chain redesign can overcome these barriers. As demonstrated by Brazil’s export tax incentives and the EU’s quality-based subsidy programs, targeted policy interventions can effectively shift production toward higher-value soy products. The U.S. can leverage similar approaches through USDA grading reforms and Farm Bill provisions that reward protein content and sustainability.

Technological solutions like GeoPard’s precision agriculture tools offer a practical pathway for farmers to improve soy quality while maintaining profitability, with proven results including 8% protein increases in European trials.

These innovations become increasingly valuable as consumer demand grows for sustainably-produced poultry, with the climate-smart poultry market expanding by 28% annually. This transformation would create new revenue streams for farmers, improve efficiency for poultry producers, and reduce the environmental impact of animal agriculture – a true win-win scenario for all stakeholders in the agricultural value chain.

Precision Farming